Investment: SEIS & EIS for business funding

The SEIS/EIS schemes should be considered by all growth focused start-ups for both proving investment potential and to attract cash-ready equity investors.

What is the Investment: SEIS & EIS scheme?

The (Seed) Enterprise Investment Scheme, (S)EIS is a win-win for both businesses looking to raise capital at an early stage and for investors looking for tax efficient benefits in return for investment.

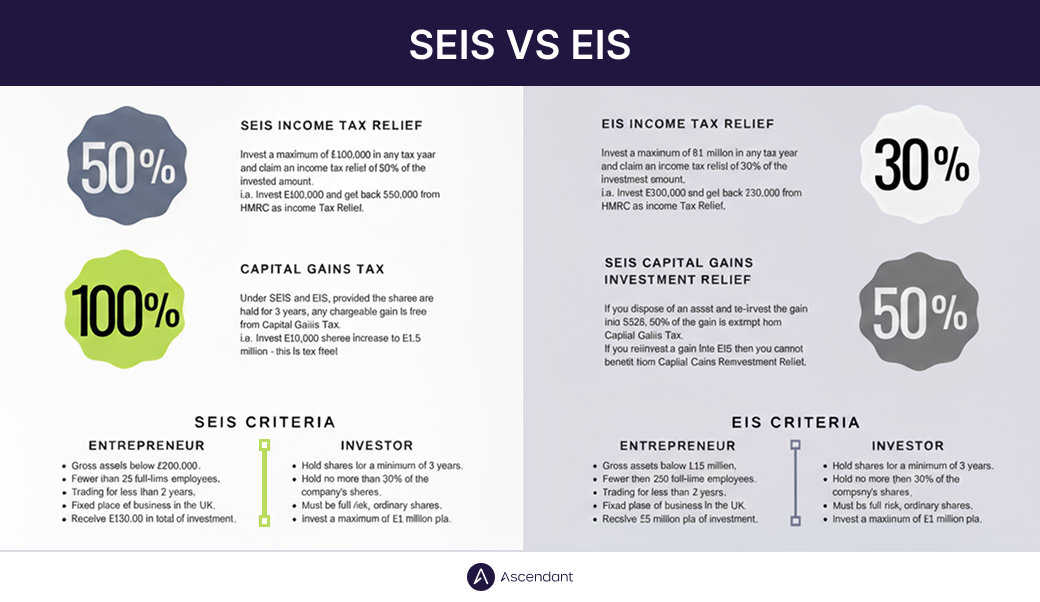

Designed to boost economic growth, (S)EIS investors can receive up to 50% SEIS and 30% EIS tax relief in the tax year the investment is made, or even carry the tax relief back to the prior year. This is great news for start-up companies looking for finance at a time in their business journey where other financial institutions are reluctant to invest at such a risky time.

The Seed Enterprise Investment Scheme (SEIS) is a win-win for both businesses looking to raise capital at an early stage.

Benefits to businesses looking for finance

Lots of (S)EIS service providers talk about the benefits to the investor of (S)EIS and as a side note the business receives funding to help its growth. We always view it from the point of view of the business looking to utilise the (S)EIS scheme to help fuel growth.

Growth & Capital

As a young company with limited options for finance, SEIS can provide much needed growth and capital.

Backing

Becoming pre-assured and gaining access to SEIS funding, your business will have strong backing for future finance raising.

Expertise

Gaining access to SEIS investors also gives access to their expertise, which can fuel growth and future finance raising.

Direction

Applying for SEIS funding tests your business model/plan so you can be confident you’re heading in the right direction.

“Before engaging with Ascendant Accountants, we had had a bumpy period. Since engaging, we have recovered our form, and our business has gone from strength to strength, diversifying into other industries outside Formula 1 and improving both our profitability and cash position, as well as implementing plans to save us a small fortune in tax. We are ambitious for our business, and we have found a partner in Ascendant Accountants to help us achieve our ambition.”

Simon Burchett

Freeform Technology Ltd

Criteria for (S)EIS scheme applications

It is important to note the limitations of the (S)EIS scheme before applying as these rules need to be adhered to throughout the time period otherwise the investor could lose access to the tax saving benefits of the scheme. There are limitations on who can apply to the (S)EIS scheme:

Most businesses will meet the qualifying trade condition, some don’t such as: farming, land ownership, legal, accounting & financial services, leasing, property development, hotels & nursing home management, shipbuilding, coal & steel production, electricity generation and export.

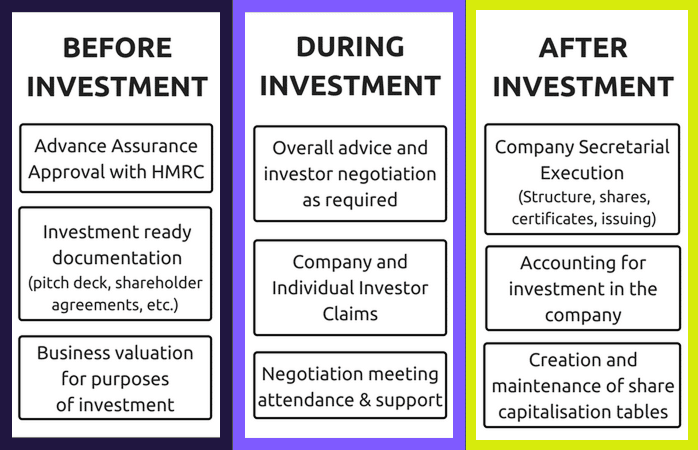

Ascendant Accountants can support your (S)EIS strategy

We’re more than just a (S)EIS application company, we support you before you submit your application, during negotiations with investors, and post investment award. We’re always by your side.

Need someone to take care of it?

Our Finance and CFO team is ready to make it happen

R&D Tax Credit

In 2000 the UK government launched R&D Tax credits. Incentivising the investment into research and innovation by organisations in exchange for tax credits by HMRC on expenditure. You could be entitled to 33p on every £1 spent.